The current economic crisis we're in sorta reminds of my grandmother's cure for all that ails you: Black Draught. It tasted awful and the results were even worse than the taste. But the alternative of doing nothing was worse still, so shut up, hold your nose and swallow your medicine.

The current economic crisis we're in sorta reminds of my grandmother's cure for all that ails you: Black Draught. It tasted awful and the results were even worse than the taste. But the alternative of doing nothing was worse still, so shut up, hold your nose and swallow your medicine.Wesley Pruden at the Washington Times likens the $1.8 trillion bailout for the current crisis to Bonnie and Clyde "dealing in wholesale" banking.

Bonnie and Clyde relieved depositors of their savings at little banks in out of the way places, dealing only in retail. The Lehman brothers and their sisters, Bear Stearns and AIG, relieved investors of their money on Wall Street and now get to relieve taxpayers of their money from coast to coast, dealing in wholesale. The brothers and sisters have given "free markets" an entirely new meaning. They're free to take the money and run, with Hank Paulson driving the getaway car.

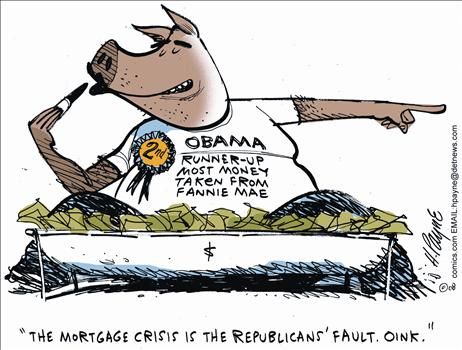

But Pruden, like all the rest of us taxpayers, will have to pay the bill. So he moves on with the obvious question: How'd we get into this mess?We're told that this is no time to play the blame game. But why not? Since we're all stockholders now in a vast Ponzi scheme, we should have some say in who gets thrown into the street and who doesn't. The Democrats are particularly eager to avoid the blame game. They fiercely opposed legislation in 2005 that would have imposed sanity on Fannie Mae and Freddie Mac, whence came this misery. The legislation was written by three senators, including, as it happens, John McCain. The senators who blocked it were, as it happens, Barack Obama, Hillary Clinton and Chris Dodd. This unholy trio took more than a quarter of a million dollars in campaign contributions from executives and employees of Fannie and Freddie. Just a coincidence, of course.

Economists Charles Calomiris and Peter Wallison provide the details in The Wall Street Journal of this Congressional whodunit from 2005.

In light of the collapse of Fannie and Freddie, both John McCain and Barack Obama now criticize the risk-tolerant regulatory regime that produced the current crisis. But Sen. McCain's criticisms are at least credible, since he has been pointing to systemic risks in the mortgage market and trying to do something about them for years. In contrast, Sen. Obama's conversion as a financial reformer marks a reversal from his actions in previous years, when he did nothing to disturb the status quo. The first head of Mr. Obama's vice-presidential search committee, Jim Johnson, a former chairman of Fannie Mae, was the one who announced Fannie's original affordable-housing program in 1991 -- just as Congress was taking up the first GSE regulatory legislation.

In 2005, the Senate Banking Committee, then under Republican control, adopted a strong reform bill, introduced by Republican Sens. Elizabeth Dole, John Sununu and Chuck Hagel, and supported by then chairman Richard Shelby. The bill prohibited the GSEs from holding portfolios, and gave their regulator prudential authority (such as setting capital requirements) roughly equivalent to a bank regulator. In light of the current financial crisis, this bill was probably the most important piece of financial regulation before Congress in 2005 and 2006. All the Republicans on the Committee supported the bill, and all the Democrats voted against it. Mr. McCain endorsed the legislation in a speech on the Senate floor. Mr. Obama, like all other Democrats, remained silent.

...If the Democrats had let the 2005 legislation come to a vote, the huge growth in the subprime and Alt-A loan portfolios of Fannie and Freddie could not have occurred, and the scale of the financial meltdown would have been substantially less. The same politicians who today decry the lack of intervention to stop excess risk taking in 2005-2006 were the ones who blocked the only legislative effort that could have stopped it.

I love a good whodunit, but I prefer ones with a happy ending. The only way this one will turn out well is a McCain-Palin victory at the polls. If Obama and Biden join Pelosi and Reid in power, we're gonna long for the good ol' days when Bonnie and Clyde robbed only one bank at a time.

No comments:

Post a Comment